Every step protected.

From hello to verified.

An AI-powered platform that checks IDs, matches faces, and catches hidden fraud, all in one automated unified platform.

Why leading businesses trust AdvanGuard Identity Verification

Because speed, accuracy, and protection shouldn't be trade-offs.

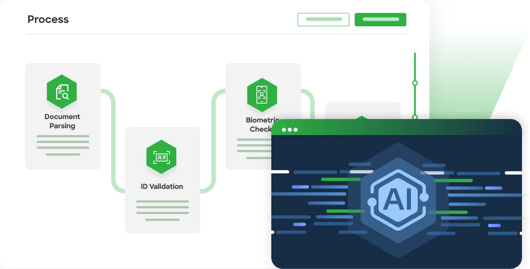

Slash 90% of manual checks

Let AI handle document parsing, ID validation, biometric checks, and risk assessment, freeing up time and reducing operational costs.

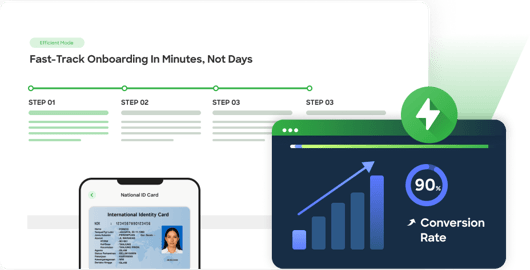

Fast-track onboarding in minutes, not days

Speed up identity and document verification so users can complete onboarding quickly and confidently. Help to boost conversions and reduce drop-offs.

Block fraud before it happens

Authenticate both the claimed and real identity using multi-layered validation, from document verification to facial biometrics. Reduce fraud at the point for verification and eliminate the blind spots that traditional method missed with AI-driven engines.

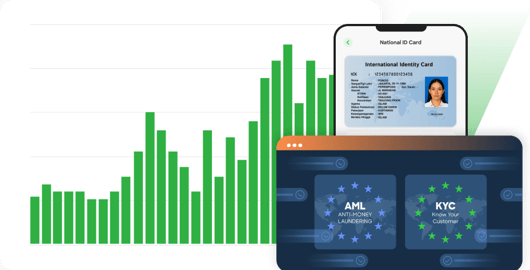

Stay KYC and AML compliant effortlessly

Ensure compliance with AML, KYC, and jurisdiction-specific requirements through secure, standards-aligned identity verification.

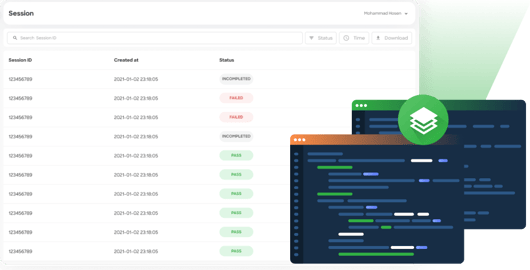

Integrate in days, not weeks

Unified API integration lets you embed our identity verification tools directly into your existing workflow without disrupting your existing infrastructure and without heavy configuration that requires deep technical knowledge to integrate this solution.

Turn identity challenges into effortless checks

Features that don’t just work. They work for you.

Skip typing, capture data in a snap

Our AI-powered Optical Character Recognition (OCR) reads and extracts text from ID documents with high accuracy. Say goodbye to manual typing and form-fill errors.

Expose fake IDs in seconds

Prompts users to capture both sides of their ID. We check for tampering, screen grabs, and black-and-white printouts using forensic-level document analysis.

See hidden fraud signals others miss

Our AI analyses device signals, behavioural anomalies, and historical pattern to flag injection attacks, replay attempts, and cross-identity risks, before fraud happens.

Detect liveness, defeat deception

Detect real presence.

We check for real human presence using passive and proactive liveness techniques, stopping fraudsters who use photos, 2D/3D masks, videos, or AI-generated faces.

Match every face to the right ID

We compare the face on the ID with a live selfie, providing a similarity score to confirm the match with precision.

Stop forged documents in their tracks

Authenticate documents using forensic techniques to spot signs of manipulation, editing, or synthetic alterations.

Built for real-world impact. Trusted across industries

Financial services

Increase account opening conversions by reducing friction and abandonment during eKYC. Ensure compliance with AML and KYC regulations, while automating document and identity checks at scale.

Digital lending & BNPL

Verify borrower identity instantly to reduce fraud and onboarding time. Ensure only legitimate users access credit and meet regulatory guidelines without manual delays.

Crypto & Web3

Meet KYC/AML requirements while preserving a fast-onboarding flow. Detect synthetic identities and deepfakes with biometric verification and protect your platform from bots and money mules.

Start verifying with confidence today

Start onboarding customers in seconds with an end-to-end identity verification that connects speed, accuracy, and fraud protection in one flow.

Book a demo nowYou may also like

How can businesses protect against AI-assisted financial fraud?

Discover multi-layered identity verification solutions to combat deepfake and AIGC threats.

Learn More

ADVANCE.AI recognised by Gartner for identity verification excellence

Discover how our comprehensive eKYC solutions help businesses mitigate risks securely.

Learn More

How Skyro achieved 50% growth with seamless digital onboarding

Discover how integrated eKYC solutions enabled friction-free fintech expansion in Philippines.

Learn More